student loan debt relief tax credit application 2021

Claim Maryland residency for the 2021 tax year. It may be possible for you to receive student loan forgiveness for the remaining balance in 20-25 years.

7 Personal Loan Companies To Have On Your Radar For Debt Consolidation Debt Relief Programs Debt Relief Loan Company

It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators.

. Advocates and borrowers hope the change will clear the way for President Joe Biden to cancel the debt. Contact us at 800-810-0989. About the Company What Is Student Loan Debt Relief Tax Credit.

From July 1 2022 through September 15 2022. Individuals paying back federal student loan debt can defer payments and interest through August 31 2022 approved April 6 2022. Ad You Qualify for Income-Based Federal Benefits under the Obama Forgiveness Program.

CuraDebt is an organization that deals with debt relief in Hollywood Florida. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are. Complete the Student Loan Debt Relief Tax Credit application.

Joe Biden supported federal student loan forgiveness of up to 10000 per borrower while running for office. In these 10 states you can get payment relief if your loan servicer is one of these companies. About the Company Student Loan Debt Relief Tax Credit Application.

CuraDebt is a company that provides debt relief from Hollywood Florida. It was established in 2000 and is a part of the American Fair Credit Council the US Chamber of Commerce and is accredited through the International Association of Professional Debt Arbitrators. However the administration has canceled more than 17 billion of debt for approximately 725000 borrowers for multiple reasons.

Student loan forgiveness for public servants. Complete the Student Loan Debt Relief Tax Credit application. The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return.

Is there relief for student loan debt during COVID-19. 0 Interest for Student Loans. Bidens presidency is just over one year old and has not made any significant student debt cancellations.

Under this kind of repayment plan you may qualify for a low or zero payment amount. Department of Education ED-owned student loans serviced by FedLoan Servicing has been temporarily reduced to 0 through August 31 2022. Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness.

Updated for filing 2021 tax returns. As a federal student. A guide for student loan forgiveness under the Borrower to Defense Repayment Program.

College Ave Student Loan. Have at least 5000 in outstanding student loan debt upon applying for the tax credit. The suspension period was originally set to apply from March 13 2020 to Sept.

The Student Loan Debt Relief Tax Credit is a program. Have the debt be in their the Taxpayers name. Under Maryland law the recipient must submit proof of payment to MHEC showing that the tax credit was used for the purpose of paying down the qualifying student loan debt.

File 2021 Maryland State Income Taxes. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are. Rossman helps us break down a hypothetical example to show how federal student loan forgiveness of 10000 would have traditionally been taxed prior to Bidens tax update. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Private loans may not be eligible for income-driven repayment. Get student loan forgiveness if you work for a qualified government or. Home Debt Help Advice Debt Relief Help Options Student Debt Relief.

One form of relief came through the suspension of payments on federal loans held by the Department of Education. Student Loan Assistance Programs are for those who make between 30k - 200k Per Year. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refundUnder Maryland law the recipient must.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan. Borrowers who make payments to multiple loan servicing agencies would need to call each lender but if you need the money. Consumers are 500 million deeper in debt with student loans than credit cards.

So where are all the breathless commercials and billboards for relief from academic loans like you see and hear everywhere for credit card. If the student meets these qualifications they can submit an online application by September 15 2021. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents Tax Year 2021 Only Instructions.

See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program. For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. If you have an approved Borrower Defense claim and have only received partial relief or your claim has been approved and your debt has not yet been cancelled.

The amount of each payment. Suspended payments will appear as regularly rescheduled payments by credit-reporting agencies. FedLoan Servicing has automatically adjusted accounts so that interest doesnt accrue ie accumulate.

Compare Best Lenders Get Low Rates From 174 APR. From July 1 2022 through September 15 2022. Ad Drowning in Student Debt.

The interest rate on all US. But there is one little-known provision regarding student loans not everyone knows about. Start with these 8 options.

All you need to do is call the lender servicing your student loan with this information. Whose student loans will be forgiven. Specifically Section 2206 of the CARES Act created a temporary tax-free provision for employer student.

You may be eligible based on your income type of loan and the date when the loan was made. Borrower defense is a program that protects student loan borrowers after the institution they attended participated in misconduct andor misled them. How many of the payments you want refunded.

Maryland taxpayers who maintain Maryland residency for the 2022 tax year. Student loan forgiveness is now tax-free thanks to a provision included in the 19 trillion. The dates you made payments.

How to Get Your Payments Refunded. This application and the related instructions are for Maryland residents who wish to claim the Student Loan Debt Relief Tax Credit.

Tax Day Man Filing Us Tax Form Tax Form Us Business Income Office Hand Fill Concept In 2021 Tax Debt Irs Taxes Debt Relief

Student Debt Forgiveness Would Impact Nearly Every Aspect Of People S Lives In 2021 Debt Forgiveness Student Debt Student

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

President Biden Extended The Student Loan Payment Freeze Until May 2022 Nextadvisor With Time

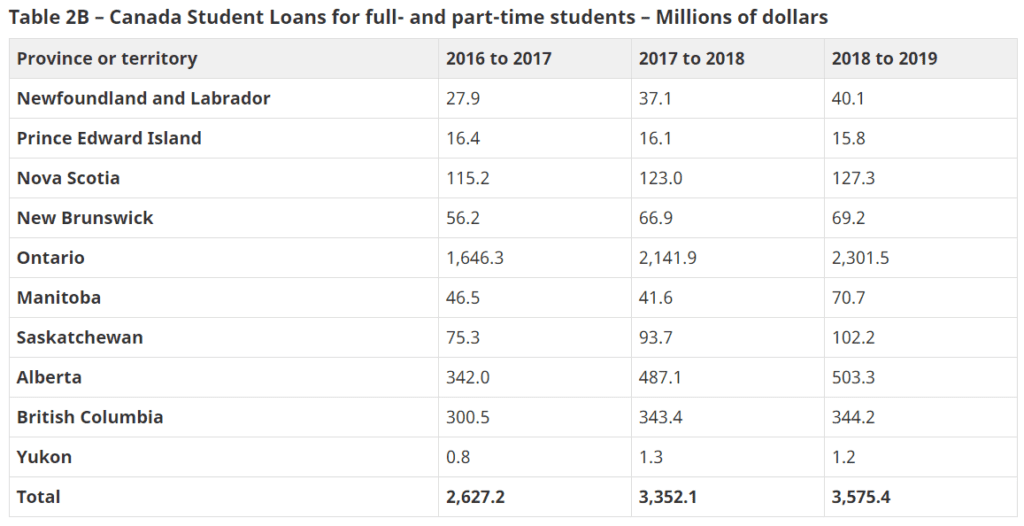

Student Loan Forgiveness In Canada Loans Canada

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Student Loan Debt Forgiveness In Canada Consolidated Credit Ca

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

Best Personal Loans Of March 2022 Nerdwallet Debt Relief Programs Best Payday Loans Personal Loans

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

The Distributional Effects Of Student Loan Forgiveness Bfi

Student Loan Forgiveness In Canada Loans Canada

Is Interest On Student Loan Debt Tax Deductible Consolidated Credit Ca

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Get A Student Loan Tax Deduction The Turbotax Blog

![]()

Student Loan Forgiveness In Canada Loans Canada

Student Loan Forgiveness In Canada Loans Canada

How Student Loan Forgiveness Is Altering Consumer Behavior Thehill Student Loan Forgiveness Student Loans Consumer Behaviour

The 20 Best Work From Home Jobs Of 2021 Bankrate Finance Saving Paying Off Credit Cards Savings Strategy